Capitec Bank Cards offer cash back rewards and free delivery. This makes them a top choice for those seeking credit card perks.

You can enjoy a credit limit of up to R500,000, giving you the freedom to spend as you wish.

Using Capitec Bank Cards lets you earn back a portion of your monthly spend.

Check out the exclusive ones for you

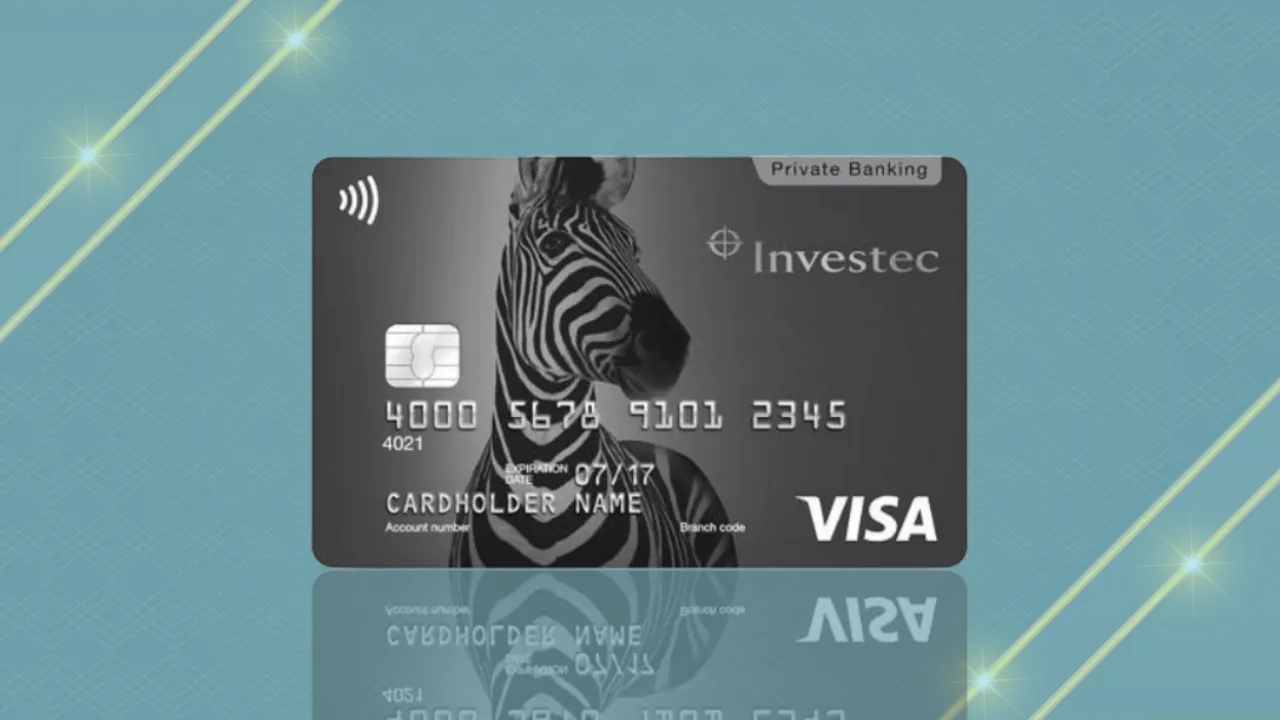

Ver todas as ofertasInvestec Credit Card

Limit up to 15.000

Free Annual Fee

🎁 5 benefits for you

Nedbank Card

Limit up to 5.700

Free Annual Fee

🎁 5 benefits for you

This is thanks to their cash back rewards.

Plus, you get free delivery on your purchases, adding to the convenience.

is not part of this section, we proceed with Key Takeaways

is not part of this section, we proceed with Key Takeaways

Key Takeaways

By clicking the button you will remain on this website.

- You can get cash back rewards with Capitec Bank Cards on your monthly spend.

- Capitec Bank Cards offer free delivery, making it a convenient option.

- The credit limit of up to R500,000 provides flexibility and convenience.

- Capitec Bank Cards offer a range of credit card benefits, including cash back rewards.

- You can maximize your rewards with Capitec Bank Cards and enjoy a seamless experience.

- Capitec Bank Cards are designed to provide a rewarding experience with cash back rewards and free delivery.

- With Capitec Bank Cards, you can enjoy the benefits of cash back rewards and free delivery on your purchases.

Understanding Capitec Bank Cards and Their Benefits

Exploring Capitec Bank Cards opens up a world of convenience. You can use your card online, in stores, or with digital wallets like Apple Pay. This makes paying easy and flexible.

Capitec Bank's credit cards are designed to fit your needs. They offer a safe and dependable way to handle your money. You can shop online or in stores without any trouble. The perks of using Capitec Bank Cards include:

- Easy online transactions

- Convenient in-store payments

- Seamless digital wallet transactions

- Secure and reliable credit card services

Choosing Capitec Bank Cards means getting a lot of benefits. You get easy digital payments and safe credit card services. Capitec Bank is a great choice for your financial needs.

| Benefit | Description |

|---|---|

| Digital Payment Integration | Seamless transactions online, in-store, or through digital wallets |

| Credit Card Services | Secure and reliable way to manage your finances |

Cash Back Rewards and Spending Benefits

Capitec Bank Cards offer 1% cash back on all your spend. This makes them great for those wanting to earn more rewards. With a credit limit of up to R500,000, you can enjoy big spending benefits. To get the most from your rewards, it's important to understand how they work and how to build them up over time.

Here are some key benefits of the cash back rewards system:

- Earn 1% cash back on all spend, with no restrictions on categories or merchants

- High credit limit of up to R500,000, allowing for significant spending benefits

- No rotating categories or spending limits, making it easy to earn rewards

To maximize your cash back rewards, consider the following strategies:

- Use your Capitec Bank Card for all your daily purchases, including groceries, gas, and dining

- Take advantage of the high credit limit to make large purchases, such as electronics or home appliances

- Pay your balance in full each month to avoid interest charges and maximize your rewards

By following these strategies and using the cash back rewards system, you can earn a lot from your monthly spending. The Capitec Bank Card is a great choice for those wanting to earn cash back rewards and enjoy spending benefits. Its high credit limit and simple rewards system make it an excellent option.

| Feature | Benefit |

|---|---|

| Cash Back Rewards | Earn 1% cash back on all spend |

| Credit Limit | Up to R500,000, allowing for significant spending benefits |

| No Rotating Categories | No restrictions on categories or merchants, making it easy to earn rewards |

By clicking the button you will remain on this website.

Digital Payment Integration and Convenience

Digital wallets have made payment convenience a big deal for many. By linking your Capitec Bank Card to a digital wallet, you can pay with your phone or watch. This makes payments quicker and safer, as you don't need to carry a card.

Adding your Capitec Bank Card to a digital wallet is super convenient. You can pay online, in stores, or through apps without a physical card. The main perks include:

- Easy transactions: Just a few taps on your device.

- Enhanced security: Less chance of card loss or theft.

- Streamlined payments: Faster and more convenient.

Digital wallets and credit cards offer the best in payment ease. Whether shopping online or in stores, digital payments are easy. With Capitec Bank Cards and digital wallets, you get a smooth and safe payment experience.

Free Delivery and Service Perks

When you apply for a credit card from Capitec Bank, you get free delivery. This means no hassle or cost for your new or replacement card. It shows Capitec Bank's dedication to making things easy for you.

Capitec Bank also offers free delivery of credit cards. This saves you time and effort. You can start using your card right away, without the need to visit a branch or pay for delivery. It's a big plus, letting you focus on shopping and earning rewards.

Some of the key benefits of Capitec Bank's free delivery service include:

- Convenience: You can receive your credit card at your doorstep, without having to visit a branch.

- Time-saving: You can save time and effort by not having to collect your card from a branch.

- Cost-effective: You can avoid paying for delivery or collection of your credit card.

Overall, Capitec Bank's free delivery service is a great perk. It makes your banking experience better. By offering this, Capitec Bank shows it cares about making things easy and efficient for you.

Travel and Insurance Advantages

Being a Capitec Bank Card holder comes with many perks. You get travel benefits and insurance that make your trips safer and more enjoyable. These benefits protect you from unexpected events like trip cancellations or medical emergencies.

Here are some key insurance perks of using a Capitec Bank Card for travel:

- Travel insurance, which covers trip cancellations, delays, and interruptions

- Medical emergency insurance, which pays for medical costs during travel

- Lost or stolen luggage insurance, which helps you get back your lost luggage

Capitec Bank Cards also offer credit card rewards. You can use these rewards for travel expenses like flights, hotels, and car rentals. Knowing about these benefits helps you plan better and travel with confidence.

Capitec Bank Cards are a great choice for those who travel often. They offer security and rewards, making your travels more enjoyable. You can use your rewards to enhance your travel experience.

Conclusion: Making the Most of Your Capitec Credit Card

As you keep using your Capitec credit card, make sure to use all its benefits. Maximize your rewards by choosing the right purchases. Also, use the digital payment integration for easier money management. Plus, enjoy the free delivery and other perks for a better experience.

Knowing how to use your Capitec credit card's many benefits can improve your finances. Stay updated and use the credit card benefits to the fullest. This will make your financial journey better and more rewarding.

By clicking the button you will remain on this website.

FAQ

What is the credit limit for Capitec Bank Cards?

Capitec Bank Cards have a credit limit of up to R500,000. This gives users a lot of spending power and flexibility.

What are the cash back rewards on Capitec Bank Cards?

Capitec Bank Cards offer 1% cash back on all your spend. This means you can earn rewards on your monthly expenses.

How can I add my Capitec Bank Card to a digital wallet?

Adding your Capitec Bank Card to digital wallets like Apple Pay is easy. You can also use Garmin Pay, Google Pay, or Samsung Pay. This makes digital payments convenient and secure.

Does Capitec Bank offer free credit card delivery?

Yes, Capitec Bank offers free delivery of their credit cards. This saves you from the hassle and cost of getting a new or replacement card.

What travel benefits come with a Capitec Bank Card?

Capitec Bank Cards come with travel insurance and other benefits. These provide financial protection and peace of mind when you travel.

How can I maximize the benefits of my Capitec Bank Card?

To get the most from your Capitec Bank Card, use the cash back rewards and digital payment features. Also, take advantage of the travel benefits. This will improve your financial management and overall experience.