Are you searching for a credit card that fits your financial needs? Entercard has many credit cards with different perks, including some with no annual fee.

Finding the right credit card can be tough, but this guide aims to assist you in making a smart choice.

Entercard has several credit cards, each with its own special features.

Check out the exclusive ones for you

Ver todas as ofertasBTG Pactual Card

Limit up to 8.600

Free Annual Fee

🎁 4 benefits for you

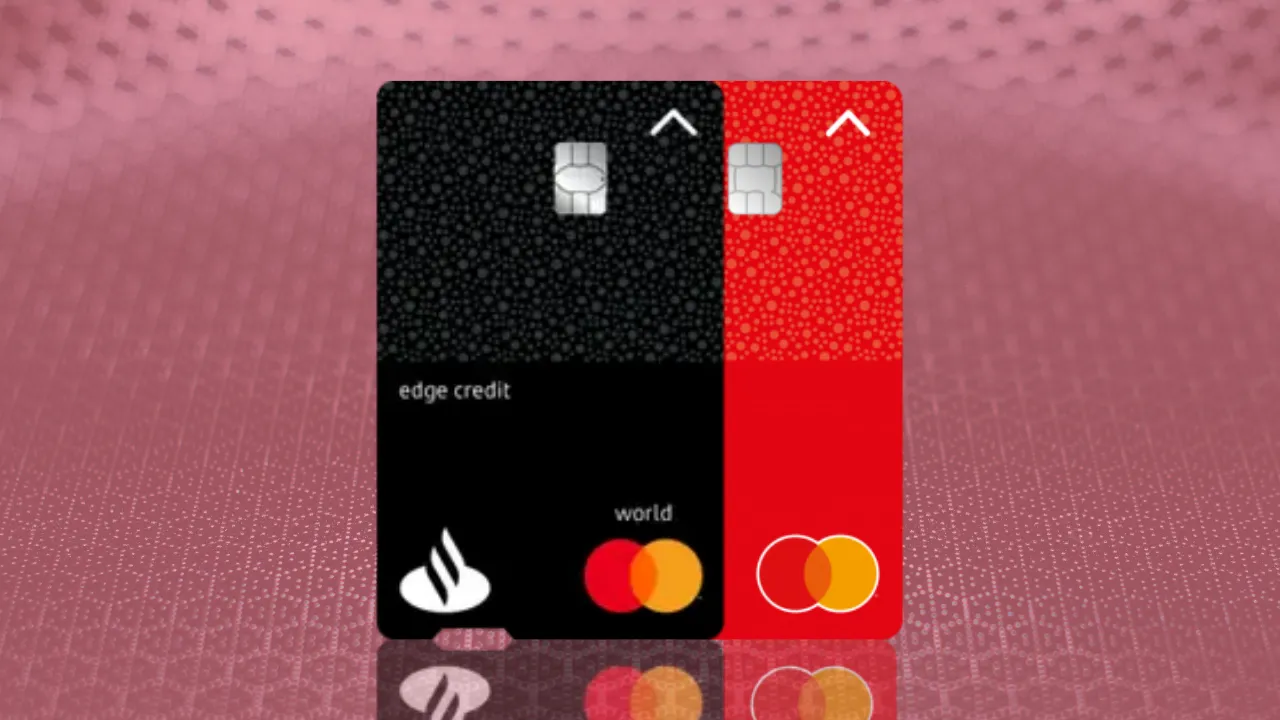

Santander Edge Card

Limit up to 12.500

Free Annual Fee

🎁 6 benefits for you

It's important to compare them to find the one that matches your spending and financial goals.

This guide will show you the different Entercard credit cards, their main features, and benefits.

By clicking the button you will remain on this website.

It will help you pick the best one for you.

Key Takeaways

- Entercard offers a variety of credit cards to suit different needs.

- Some Entercard credit cards come with no annual fee.

- Comparing credit cards is crucial to finding the best fit for you.

- This guide will help you understand the features and benefits of each Entercard credit card.

- Making an informed decision when choosing a credit card is essential for your financial health.

- Entercard credit cards offer various rewards and benefits.

What Makes Credit Cards a Valuable Financial Tool

Credit cards are a key part of our financial lives today. They offer both convenience and security. They let you pay in different ways, helping you manage your money better.

They also give you quick access to cash when you need it. This makes them a safety net in emergencies.

- Enhanced security features, such as fraud protection and purchase insurance

- Rewards programs that offer cashback, travel points, or other incentives

- Flexible payment plans, enabling you to manage your cash flow

| Benefits | Description |

|---|---|

| Security | Enhanced fraud protection and purchase insurance |

| Rewards | Cashback, travel points, or other incentives |

| Flexibility | Flexible payment plans for better cash flow management |

It's important to use credit cards wisely to get the most out of them. This way, you can enjoy their benefits while keeping your finances healthy.

Overview of Entercard Credit Cards in Norway

Entercard Credit Cards are popular in Norway for good reasons. They have no annual fee. This makes them a great choice for those who want to handle their money wisely.

These credit cards offer many benefits. They suit different needs. Here are some of the perks:

- Competitive interest rates

- Flexible payment plans

- Rewards programs tailored to various lifestyles

- Secure online transaction processing

These features make Entercard Credit Cards very useful. They are perfect for everyday spending or for reaching financial goals. Entercard's options are definitely worth looking into.

Key Factors to Consider When Choosing a Credit Card

Choosing a credit card involves looking at several key factors. This ensures you pick the right one for your financial situation. With so many options, it's important to evaluate these factors carefully.

Annual fees are a big consideration. Some cards, especially those with extra perks, have high fees. You should decide if the benefits are worth the annual cost.

Interest rates are also crucial. If you carry a balance, a lower rate can save you money. Look for cards with low rates or consider a 0% introductory APR for big purchases.

Rewards programs are another important factor. Cards offer different rewards like cashback, travel points, or merchandise. Choose a card that matches your spending habits and preferences.

Lastly, think about the credit limit. A higher limit can be useful for big purchases or improving your credit score. But, make sure you can handle the credit responsibly.

By carefully considering these factors, you can find an Entercard credit card that fits your needs. It should also offer benefits like purchase protection and travel insurance.

Popular Entercard Credit Card Options

Looking for a new credit card? Entercard has a wide range to choose from. Each card is made for different needs and likes.

Entercard Gold Credit Card

The Entercard Gold Credit Card is a top pick. It comes with travel insurance, purchase protection, and a good interest rate.

- Pros: High credit limit, travel insurance, purchase protection

- Cons: Annual fee, higher interest rate for cash advances

Entercard Platinum Credit Card

The Entercard Platinum Credit Card is for those who want the best. It offers airport lounge access, concierge service, and more rewards.

- Pros: Premium services, higher rewards earning rate, travel insurance

- Cons: Higher annual fee, stricter eligibility criteria

| Credit Card Features | Entercard Gold | Entercard Platinum |

|---|---|---|

| Annual Fee | 800 | 2,500 |

| Interest Rate | 22.99% | 22.99% |

| Rewards Program | 1 point per 100 | 2 points per 100 |

| Travel Insurance | Up to 2 million | Up to 5 million |

Choosing between Entercard Gold and Platinum depends on your spending and goals. Know what each card offers to use it best for you.

By clicking the button you will remain on this website.

Specialized Entercard Credit Cards for Different Lifestyles

Entercard has a variety of credit cards for different lifestyles. Whether you travel a lot, love to shop, or enjoy trying new foods, there's a card for you. Each card is designed to fit your lifestyle perfectly.

Travel Credit Cards

Travel credit cards are for those who love to explore. They offer travel points, airline miles, or hotel stays. Plus, they come with travel insurance, so you can travel without worry.

- Earn travel points on every purchase

- Access to airport lounges worldwide

- Travel insurance for unforeseen trip cancellations or interruptions

Shopping Credit Cards

Shopping credit cards are great for those who love to shop. They offer rewards and discounts at partner retailers. You can save money and earn points for future shopping.

| Card Feature | Benefit |

|---|---|

| Rewards Points | Earn points on every purchase, redeemable for shopping vouchers |

| Exclusive Discounts | Enjoy discounts at partner retailers |

| Purchase Protection | Protection against defective or not-as-described items |

Dining Credit Cards

Dining credit cards are perfect for food lovers. They offer rewards and cashback on dining purchases. You also get perks like restaurant reservations and exclusive dining events.

- Cashback on dining purchases

- Access to exclusive dining events and restaurant reservations

- Rewards points for dining out

Choosing the right Entercard credit card can make your daily activities more rewarding. Think about your habits and preferences to find the best card for you.

Comparing Entercard Credit Cards: Which One Is Right for You?

Choosing the right Entercard credit card means looking at all your options. Each card has its own set of features, benefits, and rewards. It's important to think about what you need and want to make the best choice.

Entercard credit cards are for everyone, from those who want low interest rates to those who love rewards. To pick the right one, let's look at what each card offers.

| Credit Card | Annual Fee | Interest Rate | Rewards Program |

|---|---|---|---|

| Entercard Classic | 0 | 15.99% | 1% cashback on all purchases |

| Entercard Gold | 99 | 12.99% | 2% cashback on travel and dining |

| Entercard Platinum | 299 | 9.99% | 3% cashback on travel and dining, 1% on other purchases |

Think about how you spend money and what you want to achieve. If you always pay off your balance, a card with high rewards might be best. But if you often carry a balance, a lower interest rate is more important.

By looking at what each Entercard credit card offers, you can pick the one that fits your life and goals.

Application Process for Entercard Credit Cards in Norway

Thinking about getting an Entercard Credit Card? It's important to know how to apply. First, pick the card that fits your financial needs and goals.

To apply, you'll need to share personal and financial details. You can do this online through the Entercard website or other approved places.

- Documents needed include ID and proof of income.

- Criteria for eligibility might be age, income, and credit history.

After you apply, your application will be checked. You'll then get a notice about the outcome. Make sure you meet the requirements and have all the needed documents to make the process smoother.

Conclusion: Making the Most of Your Entercard Credit Card

Entercard offers many benefits for managing your money in Norway. By picking the right Entercard credit card, you can get rewards and flexible payments. Plus, you get strong security features.

Using your credit card wisely is key to a healthy financial life. To get the most from Entercard, pay on time, track your spending, and don't spend too much. This smart use of your card will help you reach your financial goals.

Knowing what you need and choosing the right Entercard card can improve your money management. It makes banking easier and more efficient for you.

By clicking the button you will remain on this website.

FAQ

What are the eligibility criteria for applying for an Entercard credit card in Norway?

To get an Entercard credit card, you must live in Norway and be over 18. You also need a steady income. You'll have to show ID and proof of income.

Are there any annual fees associated with Entercard credit cards?

Many Entercard cards don't have annual fees. But, always check the card's details. Some might have fees for special features or benefits.

How do I apply for an Entercard credit card?

To apply, visit the Entercard website. Fill out the form and provide the needed documents. You can also get help from Entercard's customer service.

What is the interest rate on Entercard credit cards?

The interest rate on Entercard cards changes based on the card and your credit score. You can see your rate on your statement or by calling Entercard.

Can I use my Entercard credit card abroad?

Yes, you can use your Entercard card abroad. But, you might face a foreign transaction fee. Check your card's terms for any fees.

How do I report a lost or stolen Entercard credit card?

If your card is lost or stolen, call Entercard's customer service right away. They'll help you cancel your card and get a new one.

Can I request a credit limit increase on my Entercard credit card?

Yes, you can ask for a higher credit limit by contacting Entercard's customer service. They'll check your account and credit score to see if you can get a higher limit.