Kiwibank Cards continue to stand out for one key reason—smart spending starts with the right credit card. You may have read about their benefits before. Zero annual fees.

Travel perks. Practical design. This article takes it one step further.

The world of credit isn’t just about spending—it’s about control.

Kiwibank knows this. And it shows in every detail of their card offerings.

If you’re thinking about applying, timing and strategy are everything.

The application process itself? Surprisingly simple.

But there’s a lot you can do to boost your chances before hitting submit.

Think of this as your insider guide, an extension of what we previously explored.

The benefits are real. Now it’s time to make them yours.

You’ll discover how to prepare your application, what the bank looks for, and how to shine.

This is more than advice—it’s your action plan.

From eligibility to credit checks, nothing here is guesswork.

Even small moves can shift the odds in your favor.

Let’s break it down, remove the noise, and put you in the strongest position possible.

By the end, you won’t just know how to apply—you’ll know how to apply well.

The application process isn’t a wall. It’s a door. Let’s open it.

And yes, you can do it all online. Let’s go.

Increase Your Odds: How To Boost Approval Chances

Before you apply for any credit card, there are steps you can take to stand out. Here’s how to strengthen your application:

- Check Your Credit Score

Make sure your credit history is healthy. Dispute any inaccuracies early. - Reduce Outstanding Debt

High existing balances signal risk. Pay down as much as possible. - Avoid Multiple Applications

Applying for too many credit lines in a short period can hurt your score. - Show Stable Income

Regular, verifiable income reassures lenders about your repayment ability. - Keep Personal Info Updated

Mismatched addresses or outdated employment details can delay or damage your application. - Consider Timing

Avoid applying right after major life changes unless necessary (e.g., job switch, relocation). - Use Pre-Approval Tools If Available

Kiwibank doesn’t always offer this, but if they do—start there. - Avoid Overextending

Only apply for what you truly need. A lower limit card is easier to approve. - Build History With Kiwibank

Already a customer? Keep accounts in good standing—it helps. - Provide Clear Documentation

When requested, upload readable and up-to-date paperwork.

Mastering The Application: Step-By-Step For Success

Applying for a Kiwibank credit card is fully online—and made to be stress-free. But knowing each step in detail helps ensure nothing goes wrong.

Step 1: Choose The Right Card

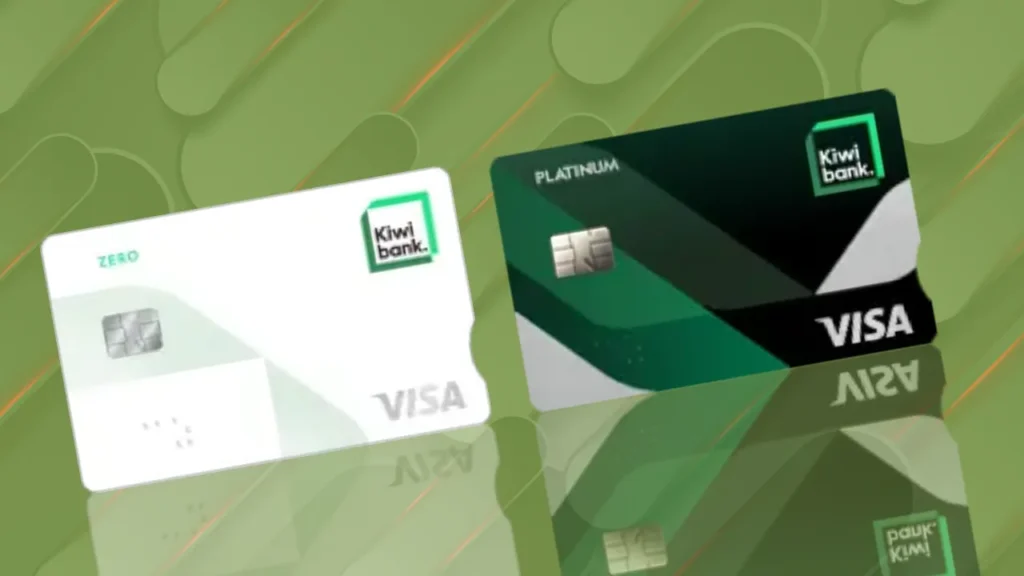

Kiwibank offers two main cards:

- Zero Visa: no account fee, practical everyday card

- Platinum Visa: includes travel insurance, better suited for frequent flyers or higher spenders

Make sure you know the benefits of each and choose based on your lifestyle.

Step 2: Review The Eligibility Criteria

Generally, to apply you’ll need:

- Be at least 18 years old

- Be a NZ resident or citizen

- Have a steady source of income

- Possess a satisfactory credit history

Double-check these before moving forward.

Step 3: Gather Your Documents

It’s easier to apply when you have your documents ready. You may need:

- Proof of income (recent payslips or tax returns)

- Proof of identity (passport, driver’s license)

- Proof of address (utility bill or bank statement)

Step 4: Visit The Kiwibank Website

Go to the official Kiwibank credit card page and select Apply Now under your chosen card.

Step 5: Start The Online Application

You’ll be asked to enter:

- Personal information (name, date of birth, contact info)

- Employment details (income, role, length of employment)

- Financial details (rent or mortgage, other debts)

Step 6: Review And Submit

Before submitting, review everything. One wrong digit can delay approval.

Step 7: Wait For Processing

Processing times vary. Some hear back within hours, others may take a few business days depending on verification.

Step 8: Respond To Any Follow-Ups

Kiwibank may request more documents or clarification. Respond promptly to avoid delays.

Step 9: Receive Your Decision

If approved, your card will be mailed to you and activated via the Kiwibank mobile app or phone.

Step 10: Activate And Start Using Responsibly

Once your card arrives, activate it and begin using it wisely—ideally staying below 30% of your credit limit.

Conclusion

Getting a credit card is more than just filling out a form—it’s a strategic step in your financial journey. And with Kiwibank, the process is designed to be as straightforward as it is empowering.

When you prepare well, understand what’s expected, and apply mindfully, you give yourself a real advantage.

Let your credit choices reflect not just your needs today, but your goals tomorrow. Be proactive, be smart, and let smarter spending truly begin.

By clicking the button you will be redirected to another website.

Frequently Asked Questions

1. Do I need to be a Kiwibank customer to apply?

No, both new and existing customers can apply online.

2. How long does the approval process take?

Most applications are processed within a few business days, some even faster.

3. Is there a minimum income requirement?

Not publicly listed, but stable income is necessary. Amounts vary depending on the card.

4. Can I apply if I have bad credit?

You can apply, but approval is less likely. It’s best to improve your credit first.

5. Are there any application fees?

No, applying for a Kiwibank card is free.

6. What’s the credit limit for new applicants?

It varies based on income, credit history, and the card selected.

7. Can I apply from outside New Zealand?

No, you need to be a resident or citizen and located in NZ at the time of application.

8. What if I make a mistake on the application?

You can contact Kiwibank to correct it, but delays may occur.

9. Can I cancel my application after submitting?

Yes, contact Kiwibank directly to withdraw your application.

10. Will applying affect my credit score?

Yes, a hard inquiry is recorded and may lower your score temporarily.

11. Can I request a specific credit limit?

You can suggest one, but the final amount is decided by Kiwibank.

12. What if I’m self-employed?

You’ll need to provide proof of income like tax returns or business statements.

13. Are balance transfers available on these cards?

Yes, subject to eligibility and promotional terms.

14. Can I use the card immediately after approval?

No, you must wait to receive and activate the physical card.

15. Do I need to upload documents during the application?

Often yes, especially proof of income and ID.

16. What should I do if I’m declined?

You can ask for the reason and work on improving those areas before reapplying.

17. Can I track my application status?

Yes, Kiwibank may provide email updates or let you check via your online banking.

18. Can I use the card internationally?

Yes, both cards are Visa and accepted worldwide.

19. Is customer support available during the application?

Yes, Kiwibank offers support online, via phone, and in-branch if needed.

20. Can I save my application and return to it later?

Usually yes, but always confirm if session timeouts may erase progress.