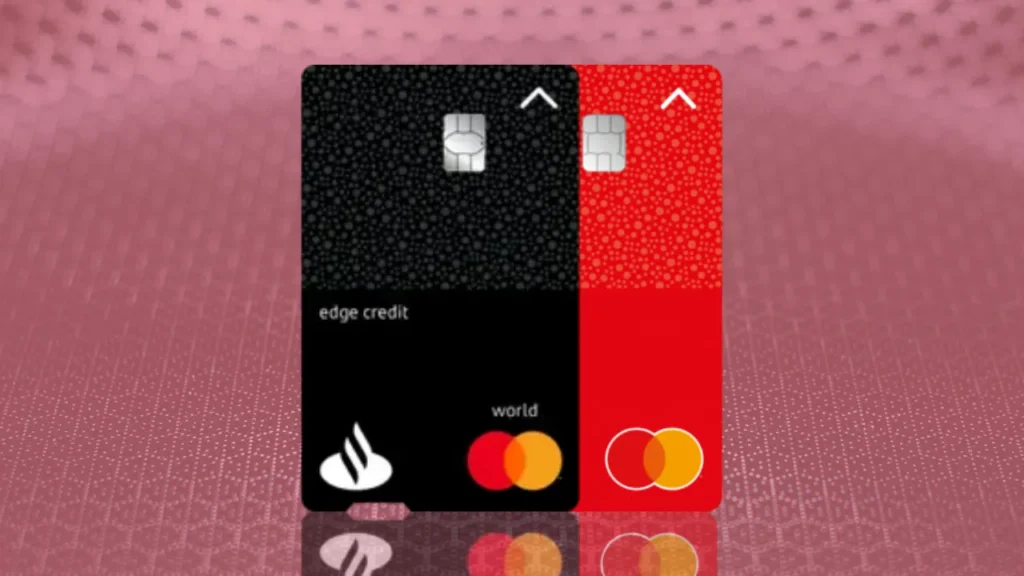

Are you searching for a credit card that does more than just make purchases easy? The Santander Edge Card is here to offer you a rewarding experience.

It gives you control over your spending and comes with strong security features.

This card lets you earn 1% cashback on all your purchases. It’s perfect for everyday spending.

Check out the exclusive ones for you

Ver todas as ofertasSynchrony Cards

Limit up to 4.500

Free Annual Fee

🎁 7 benefits for you

Cadence Cards

Limit up to 7.800

Free Annual Fee

🎁 5 benefits for you

Revolut Cards

Limit up to 12.500

Free Annual Fee

🎁 4 benefits for you

Monabanq Visa Platinum Card

Limit up to 6.800

Free Annual Fee

🎁 5 benefits for you

Citi Custom Cash Card

Limit up to 15.700

Free Annual Fee

🎁 6 benefits for you

Plus, you won't pay foreign exchange fees on purchases made abroad in the local currency.

This makes traveling internationally more budget-friendly.

By clicking the button you will remain on this website.

Key Takeaways

- Earn 1% cashback on all purchases with the Santander Edge Card.

- No foreign exchange fees on international transactions.

- Robust security features to protect your account.

- Control over your spending with advanced card management.

- A rewarding credit card experience tailored to your needs.

What Makes the Santander Edge Card Stand Out

The Santander Edge Card is special because of its rewards, control, and security. It has a simple rewards program that sets it apart from other cards.

This card gives you 1% cashback on all purchases. You earn rewards on your daily spending without dealing with complicated rules. It's great for those who like things straightforward.

It also doesn't charge foreign exchange fees for purchases abroad in local currency. This makes it perfect for travelers, saving them money on international transactions.

The card has advanced control features and strong security. This gives cardholders peace of mind and helps them manage their accounts well.

In summary, the Santander Edge Card offers a rewarding cashback program, travel-friendly features, and top-notch security. It's a top choice in the competitive credit card market.

Earning Rewards with Your Santander Edge Card

The Santander Edge Card's rewards program is easy to use. You can earn cashback on eligible purchases. This means you get 1% cashback on all your purchases, making it simple and rewarding.

Eligible Purchase Categories

The Santander Edge Card offers cashback on many everyday expenses. You can earn cashback on things like groceries, dining, and fuel. This way, you don't have to deal with complicated reward categories or switch between different spending categories.

- Groceries

- Dining

- Fuel

- Other everyday expenses

Cashback Calculation Method

The cashback is easy to calculate: you earn 1% on eligible purchases. For example, spending 1,000 earns you 10 in cashback. This cashback is usually added to your account each month.

| Purchase Amount | Cashback Earned |

|---|---|

| 100 | 1 |

| 500 | 5 |

| 1,000 | 10 |

Earning rewards with the Santander Edge Card is straightforward and rewarding. By knowing the eligible categories and how cashback is calculated, you can get the most out of your card.

Travel Benefits and Foreign Transaction Advantages

The Santander Edge Card makes traveling easy by avoiding foreign transaction fees. You can use your card abroad without extra charges on your purchases.

One big perk of the Santander Edge Card is no foreign exchange fees on purchases overseas. This means you can shop, eat, or book travel services abroad without extra fees.

How It Works in Different Countries

Wherever you go, your Santander Edge Card works the same as at home. You can buy things or get cash from ATMs, enjoying the same benefits and rewards you get in the US.

- Make purchases in the local currency without foreign transaction fees.

- Withdraw cash from ATMs worldwide with competitive exchange rates.

Currency Conversion Process

The currency conversion for your Santander Edge Card is easy and clear. When you buy something or get cash abroad, it's converted to your billing currency at a good rate.

Here are some key points about the currency conversion:

- Competitive exchange rates are used for transactions.

- No foreign transaction fees are applied.

- You can see the exchange rate used for your transaction on your statement.

Knowing how your Santander Edge Card works abroad helps you enjoy your travels more. You get the convenience, security, and rewards of using your card.

Pay Smarter with the Santander Edge Card

Santander Edge Card holders get smart payment features. These help manage credit card payments well. The card offers flexibility and control over payments, making finance management easier.

Flexible Payment Options

The Santander Edge Card has flexible payment options. You can pick a payment plan that fits your budget. You can pay online, by phone, or by mail, for your convenience.

| Payment Method | Description | Benefits |

|---|---|---|

| Online Payment | Make payments through the Santander website or mobile app | Quick, secure, and available 24/7 |

| Phone Payment | Call the Santander customer service number to make a payment | Personal assistance and immediate payment processing |

| Mail Payment | Send a check or money order to the address provided by Santander | Convenient for those who prefer traditional payment methods |

Balance Transfer Possibilities

You can transfer balances from other credit cards to your Santander Edge Card. This can save on interest and combine your debt into one payment.

Using these features, you can pay smarter. This makes the most of your credit card experience with Santander Edge Card.

By clicking the button you will remain on this website.

Control Features That Empower Cardholders

Cardholders can manage their finances better with the Santander Edge Card. It offers tools to track expenses, set budgets, and get alerts. These features help users stay on top of their money.

One important feature is real-time spending tracking. This lets you keep an eye on your money and make changes when needed. You can also set budgets for different areas, helping you stay on track financially.

Key Control Features:

- Real-time expense tracking

- Customizable budgeting tools

- Alerts and notifications for transactions and account activity

These features give you more control over your money. Using the Santander Edge Card, you can make better money decisions. This helps you reach your financial goals.

The card's mobile app and online platform make managing your account easy. You can view statements and track rewards. This ensures you're always in control of your finances.

Security Measures and Protection Benefits

The Santander Edge Card has a strong security system. It has many layers to keep your transactions safe and your personal info protected.

The card uses chip technology for extra security against fake transactions. This is better than old magnetic stripe cards, making your buys safer.

Tokenization is another key feature. It swaps your real card number with a unique token for each transaction. This keeps your real card details safe from security threats.

Also, the Santander Edge Card has zero-liability protection. This means you won't be blamed for any unauthorized transactions. It gives you peace of mind when you use your card.

Here's a quick look at the Santander Edge Card's security features and benefits:

| Security Feature | Description | Benefit |

|---|---|---|

| Chip Technology | Advanced security against counterfeit transactions | Enhanced protection for purchases |

| Tokenization | Replaces actual card number with a unique token | Protects card details from security risks |

| Zero-Liability Protection | Protection against unauthorized transactions | Peace of mind when using the card |

The Santander Edge Card offers a safe and dependable way to pay. Its advanced security measures and benefits make it a top choice for users.

How to Apply for a Santander Edge Card

The Santander Edge Card application is easy and quick. You can apply online or visit a branch. First, choose the method that works best for you.

Applying online is simple. Just go to the Santander website, find the Santander Edge Card page, and click "Apply Now." Then, fill out a secure form with your personal and financial details.

Or, you can visit a Santander branch. A representative will help you with the application. They can answer your questions and guide you through the process.

To boost your chances of approval, make sure your credit score is good. Also, provide accurate information and meet Santander's eligibility criteria. By doing this, you can get a Santander Edge Card and enjoy its rewards and benefits.

Conclusion: Is the Santander Edge Card Right for You?

The Santander Edge Card is a great choice for those who want rewards, control, and security. It offers 1% cashback on all purchases and no fees for international transactions. This means you can earn rewards while keeping your spending in check.

This card has many benefits, like travel perks and top-notch security. Think about what you need and how you spend money. If you want a card for everyday purchases or travel, the Santander Edge Card is worth looking into.

In short, the Santander Edge Card is a top pick in the credit card world. Consider its benefits and your financial goals. This will help you decide if this card is right for you and your rewards needs.

By clicking the button you will remain on this website.

FAQ

What is the Santander Edge Card?

The Santander Edge Card is a credit card. It comes with rewards, control, and security benefits.

How do I earn cashback with my Santander Edge Card?

You earn 1% cashback on all purchases. This is with the Santander Edge Card.

Are there any foreign exchange fees on purchases overseas?

No, there are no foreign exchange fees. This is for purchases overseas in the local currency with the Santander Edge Card.

How do I track my expenses with the Santander Edge Card?

You can track your expenses online or through the mobile app. It shows detailed transaction history and categorization.

What security measures are in place to protect my transactions and personal data?

The Santander Edge Card has several security features. These include chip technology, tokenization, and zero-liability protection. They help keep your transactions and personal data safe.

Can I transfer balances from other credit cards to my Santander Edge Card?

Yes, you can transfer balances from other credit cards. This gives you flexible payment options.

How do I apply for a Santander Edge Card?

You can apply online or by visiting a Santander branch.

What are the benefits of using the Santander Edge Card while traveling abroad?

The Santander Edge Card has many benefits for travel abroad. It has no foreign exchange fees on purchases overseas in the local currency. It's a great choice for travelers.

How do I manage my payments effectively with the Santander Edge Card?

You can manage payments effectively with the Santander Edge Card. Use flexible payment options like balance transfers. Also, set up alerts and notifications.