As a cardholder, you can earn rewards with every purchase you make using your Standard Bank Card.

This card offers a rewards program. You can accumulate points that can be redeemed for various rewards.

This makes your spending experience more rewarding with Standard Bank Cards and credit cards.

Check out the exclusive ones for you

Ver todas as ofertasCapitec Bank Card

Limit up to 10.300

Free Annual Fee

🎁 5 benefits for you

Nationwide Card

Limit up to 5.700

Free Annual Fee

🎁 6 benefits for you

HSBC Credit Card

Limit up to 5.700

Free Annual Fee

🎁 7 benefits for you

With secure spending and interest-free purchases, you can enjoy more convenience and flexibility in your financial transactions.

You can take advantage of the benefits offered by Standard Bank Cards.

These include their rewards program and credit cards.

Key Takeaways:

- Earn rewards with every purchase made using Standard Bank Cards

- Enjoy secure spending with Standard Bank Cards and credit cards

- Make interest-free purchases with Standard Bank Cards

- Accumulate points through the Standard Bank Cards rewards program

- Redeem points for various rewards with Standard Bank Cards and credit cards

By clicking the button you will remain on this website.

Why Choose Standard Bank Cards for Your Financial Journey

Choosing the right credit cards is key to managing your finances well. Standard Bank Cards offer many benefits tailored to your needs. The UCount Rewards program lets you earn points for every purchase, which can be used for travel, dining, and shopping.

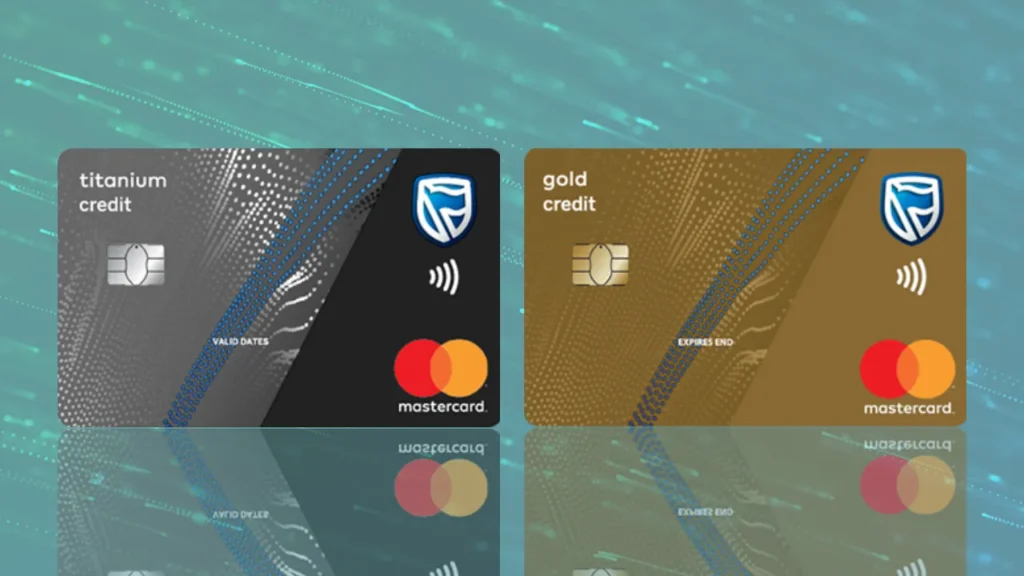

The rewards program gives you the freedom to choose how to use your points. You can treat yourself to something special or use them to cover everyday costs. With various credit cards available, like the Gold, Titanium, Platinum, and World Citizen, you can pick the one that fits your lifestyle and financial goals.

Standard Bank Cards come with several advantages:

- Earning points through the UCount Rewards program

- Access to exclusive rewards and discounts

- Flexible payment options and interest-free purchase benefits

- World-class customer service and support

By choosing Standard Bank Cards, you get the ease of credit cards plus the perks of a rewards program. With UCount Rewards, you can earn points on your purchases and redeem them for rewards that are important to you.

Maximizing Your UCount Rewards Experience

To get the most out of your UCount Rewards, it's key to know how it works. Every time you use your Standard Bank credit cards, you earn points. These points can be used for rewards like travel, dining, and shopping.

By using your credit cards for daily purchases, you earn points for rewards. This way, you can get benefits that fit your lifestyle. The UCount Rewards program makes earning and using rewards easy and rewarding.

Here are some ways to make the most of your UCount Rewards:

- Earn points on every purchase made with your Standard Bank credit cards

- Redeem points for rewards that suit your lifestyle, such as travel, dining, or shopping

- Take advantage of interest-free benefits and secure spending

By smartly using your credit cards and the UCount Rewards program, you can enjoy many benefits. The UCount Rewards program is a fantastic way to get the best from your Standard Bank credit cards. It makes your banking experience even better.

Understanding Your Interest-Free Purchase Benefits

Standard Bank Cards offer interest-free purchases. This means you can buy things without worrying about interest charges. Just make sure to pay your balance in full by the due date.

Using credit cards for interest-free purchases is smart. It helps you manage your spending better. Knowing how it works is key to using it wisely.

- Make purchases up to a certain limit without incurring interest charges

- Pay your balance in full by the due date to avoid interest charges

- Enjoy more convenience and flexibility in your financial transactions

With your Standard Bank Card, you can spend without worrying about interest. This makes managing your money easier. It's a great way to use your credit cards wisely.

By clicking the button you will remain on this website.

Premium Card Options from Standard Bank

Exploring Standard Bank cards reveals a variety of premium options. These cards aim to enhance your banking experience. They come with special features and rewards, perfect for those seeking top-notch service.

Standard Bank offers several premium cards, like the Gold, Titanium, Platinum, and World Citizen Credit Cards. Each card provides unique perks, such as travel insurance and concierge services. Choosing one means enjoying a more personalized and rewarding banking journey.

Key benefits of Standard Bank's premium cards include:

- Exclusive rewards and discounts through the rewards program

- Comprehensive travel insurance and assistance

- Personalized concierge services to help you manage your busy lifestyle

- Access to exclusive events and experiences

Looking for a card with luxury perks or practical benefits? Standard Bank's premium cards have it all. They offer a premium banking experience with rewards tailored to your needs.

Smart Banking Features That Enhance Your Lifestyle

Standard Bank Cards offer smart banking features for easy finance management. You can use mobile banking, online banking, and card controls. These tools let you make transactions and check your account activity in real-time.

Smart banking features give you real-time updates and transaction alerts. This way, you can keep a close eye on your finances. You can also lock or unlock your credit cards for extra security and convenience.

Some of the smart banking features you can expect from Standard Bank Cards include:

- Mobile banking apps for easy account management

- Online banking for secure transactions and account monitoring

- Card controls for locking or unlocking your credit cards

- Real-time account updates and transaction alerts

Using these smart banking features, you get more convenience and security in your financial dealings. Whether it's for everyday purchases or account management, Standard Bank Cards have the tools you need. They help you make the most of your financial experience.

| Feature | Benefit |

|---|---|

| Mobile Banking | Easy account management on-the-go |

| Online Banking | Secure transactions and account monitoring |

| Card Controls | Added security and convenience |

Conclusion: Making the Most of Your Standard Bank Card Benefits

Starting your financial journey with a Standard Bank Card opens up a world of benefits. You earn rewards with every purchase. These rewards can be used for valuable perks or to pay down your statement.

The card also offers secure spending and interest-free purchases. This adds convenience and flexibility to your finances.

Standard Bank's Premium cards take your banking to the next level. You get exclusive benefits and services that fit your needs. The smart banking features make managing your money easier, helping you stay in control.

In the end, the Standard Bank Card is a complete solution for your financial needs. It rewards you, keeps your spending safe, and makes managing money easy. This card empowers you to reach your goals and improve your financial health.

By clicking the button you will remain on this website.

FAQ

What are the key benefits of using a Standard Bank Card?

Using a Standard Bank card comes with many advantages. You can earn rewards with every purchase. You also get secure spending and interest-free purchases. Plus, it makes your financial transactions more convenient and flexible.

What are the premium card options available from Standard Bank?

Standard Bank has a variety of premium cards. These include:

- Gold Credit Card

- Titanium Credit Card

- Platinum Credit Card

- World Citizen Credit Card

Each card offers special benefits and rewards. They cater to those who want more service and rewards.

How can I maximize my UCount Rewards experience?

To get the most out of UCount Rewards, follow these steps:

- Earn rewards with every purchase made using your Standard Bank Card

- Understand the different reward options available, such as travel, dining, and shopping

- Redeem your accumulated points for the rewards that best suit your lifestyle

What are the interest-free purchase benefits of a Standard Bank Card?

Standard Bank Cards let you make purchases without interest charges. This makes your financial transactions more convenient and flexible. Just remember to pay your balance in full by the due date.

What smart banking features do Standard Bank Cards offer?

Standard Bank Cards come with smart banking features. These include:

- Mobile banking

- Online banking

- Card controls (e.g., locking or unlocking your card)

- Real-time account updates and transaction alerts

These features help you manage your finances securely and easily.