Are you searching for the perfect credit card? You’ve come to the right spot. With many Canadian credit cards out there, picking the best one can feel daunting.

TD has a variety of cards to fit your needs. You can find cards with cash back, Aeroplan points, or travel rewards.

Whether you love to travel or shop, there’s a card for you.

Check out the exclusive ones for you

Ver todas as ofertasRBC Cards

Limit up to 12.500

Free Annual Fee

🎁 5 benefits for you

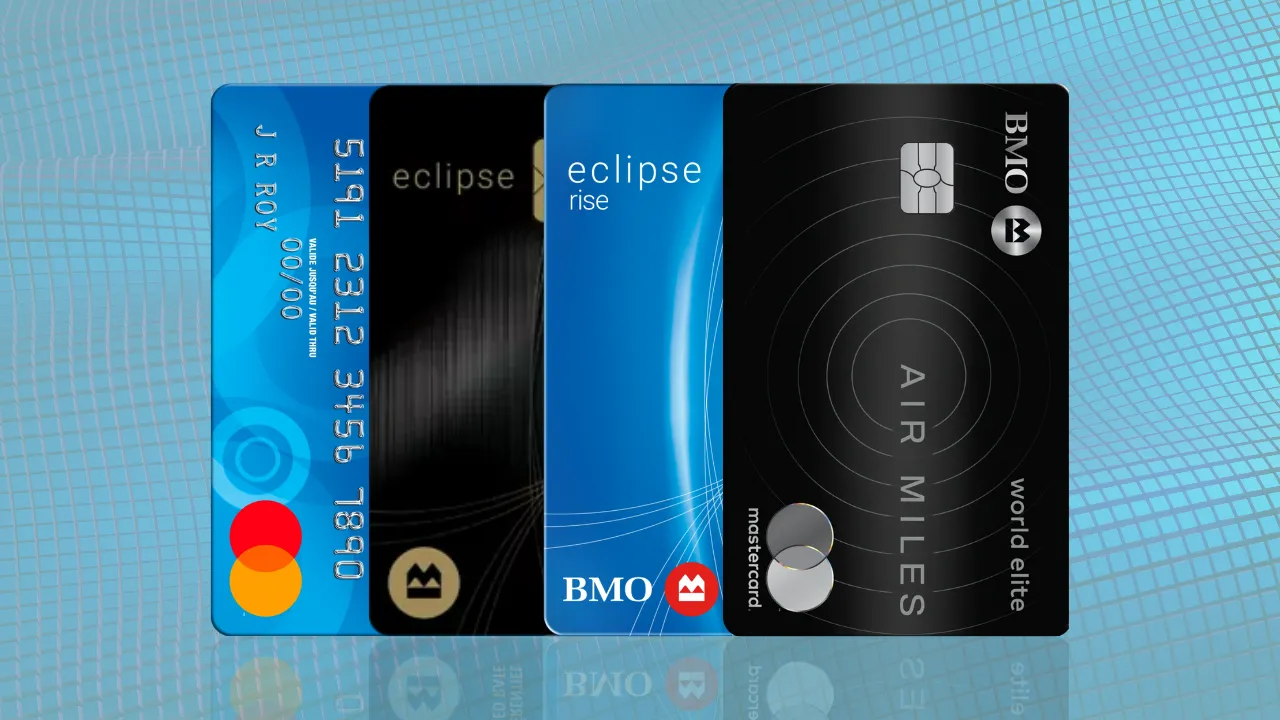

BMO Credit Cards

Limit up to 4.600

Free Annual Fee

🎁 6 benefits for you

Permanent TSB Cards

Limit up to 3.500

Free Annual Fee

🎁 7 benefits for you

Looking into the different cards can help you choose wisely.

This way, you can get the most out of your rewards.

By clicking the button you will remain on this website.

Key Takeaways

- TD offers a variety of credit cards with unique benefits.

- Cash back, Aeroplan points, and travel rewards are among the options.

- Choose a card that aligns with your spending habits.

- Maximize your rewards by selecting the right card.

- Explore the different types of cards to make an informed decision.

Exploring TD Credit Cards and Their Unique Benefits

TD credit cards offer many benefits, like cash back and travel rewards. They have features that make them special, such as earning potential and insurance coverage.

One big plus of TD credit cards is the cash back they offer. With some cards, you can get cash back on your purchases. This cash back can be used for statement credits or other rewards.

TD credit cards are also great for travelers. They let you earn points or miles for flights, hotel stays, and more. This makes them perfect for those who travel often.

Here is a comparison of some key benefits offered by TD credit cards:

| Credit Card | Cash Back | Travel Rewards | Insurance Coverage |

|---|---|---|---|

| TD Cash Back Visa Infinite Card | Yes | No | Yes |

| TD Aeroplan Visa Infinite Card | No | Yes | Yes |

| TD First Class Travel Visa Infinite Card | No | Yes | Yes |

By understanding the unique benefits of TD credit cards, you can choose the one that best suits your needs and preferences.

Types of TD Credit Cards Available in Canada

TD Bank offers a wide range of credit cards in Canada. Each card has its own special features and benefits. You can find cards that offer cashback, travel rewards, or even ones with no annual fee. TD has a credit card for every financial need.

Some popular TD credit cards include the TD Cash Back Visa Infinite Card, TD Aeroplan Visa Infinite Card, and TD First Class Travel Visa Infinite Card. These cards cater to different spending habits and reward preferences.

| Credit Card | Annual Fee | Rewards Program |

|---|---|---|

| TD Cash Back Visa Infinite Card | $120 | Cash Back |

| TD Aeroplan Visa Infinite Card | $120 | Aeroplan Points |

| TD First Class Travel Visa Infinite Card | $180 | TD Points |

If you want a card with no annual fee, TD has options for you. These cards help you manage your finances without extra costs. For those who love earning Aeroplan points, the TD Aeroplan Visa Infinite Card is perfect. It offers rewards that can be used for flights.

TD Cash Back Visa Infinite Card: Features and Benefits

Looking for a credit card with a simple cash back program? The TD Cash Back Visa Infinite Card is a good choice. It's perfect for those who want to earn cash back easily on their daily buys.

Cash Back Earning Structure

The TD Cash Back Visa Infinite Card has a great cash back system. You get 3% cash back on your top spending category each month, up to $2,000. For all other purchases, you earn 1% cash back. This makes earning rewards easy and straightforward.

Insurance Coverage and Protections

This card also comes with many insurance and protection benefits. You get auto rental collision damage waiver, trip cancellation/interruption insurance, and travel accident insurance. These features offer peace of mind when you rent cars or travel.

Pros

- Earn cash back on everyday purchases.

- Competitive earning structure with 3% cash back in your top spending category.

- Robust travel insurance and protections.

Cons

- Annual fee applies, which may offset some of the cash back benefits.

- Foreign transaction fees may apply for international purchases.

To get the most out of the TD Cash Back Visa Infinite Card, pay your bills automatically. Or, set up Pre-Authorized Payment on your TD Credit Card. This makes managing your finances easy and convenient.

TD Aeroplan Visa Infinite Card: Features and Benefits

If you love to travel, the TD Aeroplan Visa Infinite Card is perfect. It helps you earn Aeroplan points easily. This card comes with many travel benefits and rewards.

Aeroplan Points Earning Structure

The TD Aeroplan Visa Infinite Card lets you earn Aeroplan points on your daily buys. You can get:

- 3 Aeroplan points per dollar spent on eligible travel, hotel, and rental car purchases when booked through Aeroplan

- 2 Aeroplan points per dollar spent on gas and groceries

- 1 Aeroplan point per dollar spent on all other purchases

By clicking the button you will remain on this website.

Travel Benefits and Insurance

Being a TD Aeroplan Visa Infinite Cardholder comes with great travel perks. You get:

- Travel insurance coverage for trip cancellations, interruptions, and delays

- Auto rental collision/loss damage insurance

Pros

The TD Aeroplan Visa Infinite Card has many benefits. These include:

- Earning Aeroplan points on purchases

- Travel insurance coverage

- No foreign transaction fees

Cons

However, there are some downsides to consider:

- Annual fee applies

- Interest charges on outstanding balances

You can add extra cardholders to your TD Aeroplan Visa Infinite Card account. This lets them earn points and enjoy the card's benefits. It's great for families or couples who want to share rewards.

TD First Class Travel Visa Infinite Card: Features and Benefits

If you travel often, the TD First Class Travel Visa Infinite Card is perfect for you. It offers luxurious travel experiences, generous rewards, and travel insurance.

TD Rewards Points Structure

The TD First Class Travel Visa Infinite Card gives you TD Rewards points on every purchase. You get extra points for travel-related expenses. You can use these points for travel, gift cards, or merchandise.

| Category | Earning Rate |

|---|---|

| Travel | 3 points per dollar |

| Dining | 2 points per dollar |

| Other Purchases | 1 point per dollar |

Travel Benefits and Redemption Options

The TD First Class Travel Visa Infinite Card comes with travel perks like airport lounge access and travel insurance. You can use your TD Rewards points for travel, hotel stays, or other travel expenses.

Pros

- Generous rewards earnings on travel and dining

- Airport lounge access for a luxurious travel experience

- Comprehensive travel insurance for peace of mind

Cons

- Higher annual fee compared to other credit cards

- Some travel benefits may have restrictions or limitations

The TD First Class Travel Visa Infinite Card also offers flexible payment plans. This makes it easy to manage big or unexpected expenses.

Additional Features and Services for TD Credit Card Holders

If you have a TD credit card, you get extra perks. One great feature is the TD app. It makes managing your card easy.

With the TD app, you can control your spending. You can set limits, block international buys, or lock your card if lost. This keeps your money safe and your finances in check.

TD also offers tools like pre-authorized payments and TD payment plans. These help you manage your payments better. They make the most of your card's benefits.

Managing Your Credit Card with the TD App

The TD app is easy to use. You can:

- Check your balance and see your transactions

- Pay bills and move money around

- Get alerts for big purchases or low balances

Additional Benefits for TD Credit Card Holders

TD card holders also get extra benefits. These include purchase protection and travel insurance. They offer peace of mind and financial security.

Some TD cards have low rates or no annual fees. This makes them a good choice for saving money.

Using these features and services can enhance your TD card experience. You'll enjoy a more convenient and secure way to pay.

Conclusion: Choosing the Right TD Credit Card for Your Needs

Now that you've looked at the different TD Credit Cards, it's time to pick the best one for you. Canadian credit cards have many benefits, like cash back and travel perks.

Think about how you spend money, your financial situation, and what you like. For example, if you travel a lot, the TD Aeroplan Visa Infinite Card might be perfect. It offers rewards and benefits just for travelers.

The best TD Credit Card for you will depend on your personal situation. By comparing the features and benefits of each card, you can choose wisely. This way, you'll enjoy the rewards and benefits of being a TD Credit Card holder.

By clicking the button you will remain on this website.

FAQ

What are the benefits of having a TD credit card?

TD credit cards offer many perks. You can earn cash back, get travel rewards, and enjoy insurance and purchase protection.

How do I earn cash back with the TD Cash Back Visa Infinite Card?

With the TD Cash Back Visa Infinite Card, you earn cash back on your purchases. It rewards you for your daily spending.

Can I add additional cardholders to my TD credit card account?

Yes, you can add more cardholders to your TD credit card account. This lets you share the card's benefits with others.

What travel benefits are offered by the TD Aeroplan Visa Infinite Card?

The TD Aeroplan Visa Infinite Card has great travel perks. You can earn Aeroplan points, get travel insurance, and enjoy travel assistance.

How do I manage my TD credit card account through the TD app?

You can manage your TD credit card account through the TD app. It lets you set limits, block international purchases, and lock your card.

What are the pros and cons of the TD First Class Travel Visa Infinite Card?

The TD First Class Travel Visa Infinite Card has good points like earning TD Rewards points and travel redemption options. But, it might have higher fees and stricter credit requirements.

Can I set up pre-authorized payments with my TD credit card?

Yes, you can set up pre-authorized payments with your TD credit card. It makes paying bills on time easier.

How do I choose the right TD credit card for my needs?

To pick the right TD credit card, think about your spending habits and financial goals. Also, consider your credit score. Compare the features and benefits of different TD credit cards.